Business news 5 September 2024

UK private sector growth beats forecasts. Start-up investment schemes extended by 10 years. CBI, HMRC fraud, property, tax, banks, markets, insolvencies & more business news that we thought would interest our members.

James Salmon, Operations Director.

UK private sector growth beats forecasts

The private sector economy in the UK showed unexpected growth last month, with the S&P Global composite purchasing managers’ index (PMI) rising to 53.8 in August, surpassing analysts’ expectations.

UK Services enjoyed the highest level of activity in four months in August, along with the slowest rate of services price inflation for three and a half years, according to the purchasing managers’ index survey that has just dropped. The services PMI reading for August was 53.7, further above the 50 reading that separates expansion from contraction, above the 53.3 flash reading midway through the month and above the 52.5 for July.

Tim Moore, economics director at S&P Global Market Intelligence, said: “August data highlighted a recovery in UK service-sector performance as improving economic conditions and domestic political stability helped to bolster customer demand.” Despite this positive trend, businesses are apprehensive about potential tax increases in Rachel Reeves’s upcoming budget, particularly given the £22bn deficit she must address.

Analysts suggest that while the Bank of England may continue to lower interest rates, concerns about policy uncertainty could dampen future trading conditions.

Start-up investment schemes extended by 10 years

The UK Government has announced a 10-year extension of the Enterprise Investment Scheme and the Venture Capital Trust scheme until 2035, aimed at fostering growth in new and young companies. These initiatives provide tax-relief incentives to encourage investment in higher-risk businesses. The Government stated: “Thousands of entrepreneurs and start-ups are set to benefit from the extension of two leading government investment schemes to help them grow the economy and rebuild Britain.”

CBI: We’ll speak up for business

Rupert Soames, chair of the CBI, has convened leaders from over 20 major UK companies, including AstraZeneca and Barclays, to advocate for a stronger presence in financial regulation discussions. In an article for the Times, Soames emphasises that the perspectives of listed companies have been largely overlooked in regulatory debates, stating: “The voice of the listed companies was barely heard.” Soames asserts that “markets absolutely need strong, effective and efficient regulation,” but insists it must be “wise and proportionate.” The group seeks to foster a relationship of trust between boards and investors, moving away from a culture of mistrust. the newly created CBI listed companies group. The Times’ Richard Fletcher notes that the formation of the CBI listed companies group comes amid a growing debate about the regulation of the London-listed companies and before a Financial Reporting Council review of the Stewardship Code.

Live music boosts UK economy

The live music sector in the UK achieved a remarkable economic impact of £6.1bn in 2023, marking a 17% increase from the previous year and a 35% rise compared to 2019, according to research by Live. This surge was largely driven by sold-out tours from major artists like Beyonce, Sir Elton John, and Coldplay. However, the report also highlighted the ongoing struggles of grassroots venues, with 125 permanently closing in 2023. Live has urged the Government to reduce the VAT rate on live music tickets, currently at 20%, to remain competitive with other European markets.

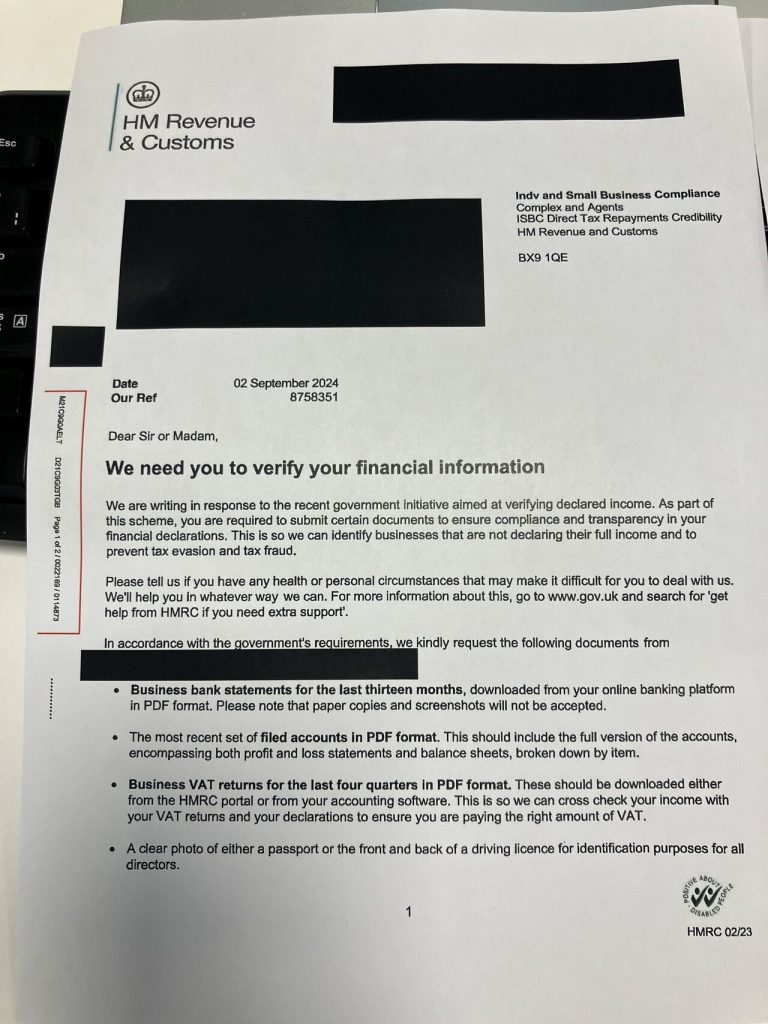

HMRC fraud rebooted

Following a warning about a convincing scam letter impersonating the HMRC tax office in our blog of 19/8/2024. (about a letter, which closely resembles an HMRC letter, asking recipients to verify their financial information). We have learned of an update to the email used to audit@hmrc-revenuecheck.com. See below.

Sajid Ghufoor, who leads Azets’ tax investigations and dispute resolution service and whose career includes 27 years working as a senior investigator for HMRC, raised the alarm in August.

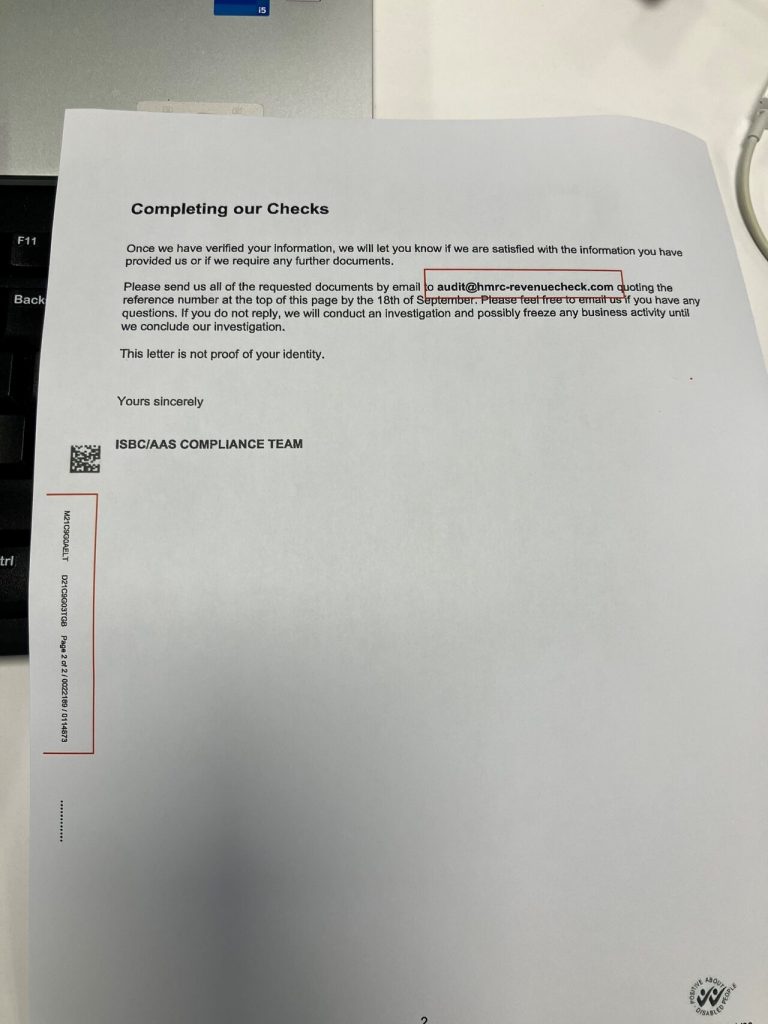

Since then, to try and keep one step ahead, the scammers have changed the fake email address on the same letter from companies-review@hmrc-taxchecks.org to audit@hmrc-revenuecheck.com

Sajid, who works out of Azets’ London office, urged people in charge of finances to always check the email address on letters – genuine ones have a hmrc.gov.uk ending.

He said: “If there is no hmrc.gov.uk ending, you are a target of sophisticated scammers. These compliance letters, with near-future deadline dates, are meant to panic businesses into providing financial information which can be used for identity theft to set up loans or clear out bank accounts.”

As previously reported, the fake compliance letter resembles the technical language and font of HMRC correspondence and could easily by mistaken for being authentic.

Sajid said in August: “This is probably the best scam letter I have seen up until now. They have sought to use an HMRC team and use the right technical legislation and language – previously others have used non-UK tax legislation.

“The highly realistic letter is headlined ‘we need to verify your financial information’ and asks for business bank statements from the past 13 months, most recent full version of filed accounts, business VAT returns for the last four quarters and photos of directors, from passports or driving licences.

“If you provide the fraudsters with these details, there is a strong chance of identity theft taking place of both the company and directors in order to clear out bank accounts and open up the opportunity for VAT fraud.

“Mimicking government messaging, these letters from criminals have the look and tone of authenticity, with ‘Indv and Small Business Compliance’ on the top right.”

The letter ends: “If you do not reply we will conduct an investigation and possibly freeze any business activity until we conclude our investigation. This letter is not proof of your identity.”

Azets urged small business owners and their staff to be on the alert, saying the scam letters may arrive by email as well as by post.

This week Sajid posted on LinkedIn, the business-to-business social media platform: “Please be vigilant. These scammers are persistent – we have seen another scam letter purporting to be from HMRC.

“The letter is exactly the same including the serial number down the left-hand side other than the email address which has been changed but still doesn’t end with .gov.uk [gov.uk].”

Based on latest government figures, there are nearly 1.2 million businesses in the UK employing one to nine staff, with nearly 223,000 employing between 10 to 49.

Sajid said: “The fraudsters have a rich reserve to pick from, which is why businesses need to be on guard.”

HMRC should be doing more to prevent scammers mimicking HMRC’s nudge letters for criminal purposes, Sajid added.

PSR lowers maximum for fraud payouts

The finance sector has welcomed a move by the Payment Systems Regulator (PSR) to lower the maximum for fraud payouts by banks from £415,000 to £85,000 after finding the lower threshold would still cover more than 99% of authorised push payment fraud cases by volume. Now industry group UK Finance has called for authorities to go further and require other sectors, such as social media companies, to take responsibility for the fraud that originates on their services. Meanwhile, consumer groups are furious accusing the PSR of caving in to lobbying from payment firms and ministers.

UK property equity hits record high

The UK’s property equity has reached an unprecedented £5.7trn, driven by recovering house prices, according to the Equity Release Council. This figure marks an increase from £5.4trn in the same period last year and surpasses the previous high of £5.6trn recorded in mid-2022. Jim Boyd, CEO of the Equity Release Council, stated: “Your prospects of living comfortably in retirement will rest on firmer foundations if you own your own home and include property wealth in your financial plans.” The study highlights that 55% of UK homeowners are over 55 years old, holding an average property equity of £321,213, which is significantly higher in London. The findings suggest that property wealth could play a crucial role in supporting the older population, especially as government pension spending is projected at £152bn for 2024/25.

Landlords flee as tax fears rise

The proportion of former rental properties for sale has reached a record high, driven by landlords’ concerns over potential increases in capital gains tax (CGT) in the upcoming budget. According to Rightmove, 18% of properties for sale were previously rentals, up from 8% in 2010. London leads with 29% of homes for sale having been rental properties, followed by Scotland and the northeast at 19%. Tim Bannister, Rightmove’s property expert, said: “In recent years it has become more attractive for some landlords to leave the rental sector rather than to continue to invest in it.” The number of new properties entering the sales market has risen by 14% compared to last year, amid fears that rising costs and taxes could further impact the rental sector.

First-time buyers warned against neglecting pensions

First-time property buyers are being warned against making financial decisions that could jeopardise their future, according to a report from Legal & General (L&G). The study reveals that nearly 20% of prospective homeowners have reduced or halted their pension contributions to afford their first home. L&G cautions that this strategy may backfire, as stopping contributions can lead to significant losses in retirement savings. For instance, a 30-year-old who pauses contributions for a year could lose £8,000 from their pension pot. Additionally, halting contributions risks losing employer-matched funds and tax relief, which are crucial for building a robust retirement fund.

State pension set to rise by more than £400 next year

The full state pension is projected to reach approximately £12,000 in 2025/26, following a £900 increase in 2023. Reports indicate that the pension could rise by over £400 annually due to the triple lock mechanism, which Chancellor Rachel Reeves has confirmed will remain in place until the end of the current Parliament. Additionally, pre-2016 retirees eligible for the secondary state pension may see an increase of £300 per year.

Markets

Global equities extended their weakness as traders awaited this week’s US payrolls data to gauge the extent of the Federal Reserve’s easing.

Yesterday, the FTSE 100 closed down 0.35% at 8269.60 and the Euro Stoxx 50 closed down 1.31% at 4848.18. Overnight in the US the S&P 500 fell 0.16% to 5520.07 and the NASDAQ dropped 0.30% to 17084.30.

This morning on currencies, the pound is currently worth $1.315 and €1.186. On Commodities, Oil (Brent) is at $73.3 & Gold is at $2514. On the stock markets, the FTSE 100 is currently up 0.1% at 8278 and the Eurostoxx 50 is down 0.3% at 4833.

Burberry has been removed from the FTSE 100 and replaced by specialist insurer Hiscox.

Labour scraps roll-out of British ISA

The new Government has scrapped the introduction of a British ISA despite Labour insisting it had “no plans” to ditch the scheme in the run up to the election. The specialist stocks and shares ISA would have allowed savers to invest an extra £5,000 tax-free in UK equities, on top of the £20,000 ISA allowance. Some investment groups applauded the move with Michael Summersgill, chief executive at AJ Bell calling the British ISA a “political gimmick that was doomed to fail in its objective” of boosting investment. Shaun Moore, tax and financial planning expert at Quilter, said the decision was sensible and the British ISA would have made that area of personal finance even more confusing.

Direct Line Insurance

Direct Line Insurance restored the dividend and returned to profit in the first half of 2024 as it reported strong premium growth. In the six months to June 30, the London-based insurer posted a pretax profit of £61.6 million, swinging from a loss of £76.3 million a year prior. Gross written premiums rose 54% to £1.84 billion from £1.20 billion. This was largely as a result of the Motability partnership which began in September 2023, the firm explained. Excluding Motability, growth was just over 11%, supported by rating action across Motor, Home, Commercial Direct and Rescue.

Budget Responsibility Bill clears the Commons

The Budget Responsibility Bill has successfully passed through the Commons, establishing a “fiscal lock” that mandates the Government to consult the independent Office for Budget Responsibility (OBR) before implementing significant tax and spending changes. Treasury chief secretary Darren Jones stated: “Every fiscally-significant change to tax and spending will be subject to scrutiny by the independent OBR.” This legislation aims to enhance the OBR’s role and ensure that the Government adheres to its fiscal mandate, thereby promoting sustained economic growth. However, opposition members, including shadow Treasury minister Nigel Huddleston, expressed concerns that the Government may alter fiscal rules at the upcoming Budget, potentially undermining the Bill’s intent.

Higher UK taxes will deter risk-takers, warn tech groups

Venture capitalists and entrepreneurs warn that the Labour government’s signal that it will raise capital gains tax and tighten the tax treatment of carried interest risks stifling the UK’s technology industry.

Non-dom reforms could bring massive losses

Labour’s plans to reform the non-dom tax regime could lead to significant financial losses for the UK government, with estimates suggesting a potential £1bn shortfall. Research from Oxford Economics indicates that the non-dom population may decrease by 32%, as wealthy foreigners consider leaving the UK due to the new rules. Chris Etherington from RSM warned: “Rather than fixing the foundations, the Chancellor could find her financial forecasts are built on sand if we see large numbers of non-doms leaving the UK.” Nimesh Shah from Blick Rothenberg added: “Given the recent dark picture painted by the Prime Minister and Chancellor, it has set even more hares running that taxes are about to exponentially increase.”

FCA warns banks over account closures

The Financial Conduct Authority (FCA) has issued a warning to UK banks regarding the denial of accounts for sex workers, stating that such actions could lead to “significant harm” for individuals. Despite the legality of sex work in the UK, banks often close accounts citing financial crime or reputational risks. The FCA is urging lenders to define reputational risk clearly to prevent the inadvertent exclusion of individuals from the adult entertainment industry. The FCA’s report highlights the challenges faced by sex workers in accessing banking services, with many relying on cash or personal accounts, which can expose them to risks such as blackmail.

Thames

What of debt-laden Thames Water? Will it soon run out of money? A new bill tweaking water company insolvency laws will be presented to parliament today. The bill cracks down on executives and updates special administration rules to ensure taxpayers aren’t left out of pocket. It hints that special administration is a growing possibility for the water supplier of all London.

Currys

Currys has reported a boost thanks to the entry of artificial intelligence-enabled products to the market. Group like-for-like revenue climbed 2% over the 17 weeks to August, the retailer reported on Thursday, aided by “encouraging early adoption” of such products in the UK and Ireland. This saw like-for-like revenue tick up 5% in the region over the period, with Currys reporting it now had an almost 50% share of the UK and Irish laptop market.

ASOS

ASOS announced the creation of a new joint venture in which 75% of its Topshop and Topman brands will be controlled by Heartland, the holding company of Danish multinational clothing business Bestseller. Heartland, which was already a major ASOS shareholder, will control 75% of the joint venture with ASOS controlling the rest.

Primark

AB Foods said Primark like-for-like revenue went into reverse in the second half of its financial year. Sales are expected to be up 4% in the half year to 14 September, with overall like-for-like sales down 0.5% as boss George Weston said growth was impacted by poor weather. The market was expecting growth nearer 7%. Primark’s added eight new stores in Europe and there in the US, where sales grew by 25%. AB Food’s grocery and ingredients divisions also saw growth, while the sugar division’s profitability was hit by a sharp decline in European sugar prices, which is expected to affect FY25 performance.

Volvo

Volvo abandoned its plan to produce only electric-vehicles by 2030. The Swedish carmaker said up to 10% of its vehicles could be “mild hybrids” by that time.

Latest Insolvencies

Petitions to wind up (Companies) – FUZZY BRUSH PRODUCTS LTD

Appointment of Liquidators – LANGUAGE RECRUITMENT SERVICES HOLDINGS LIMITED

Appointment of Administrator – PECKHAM LEVELS LIMITED

Appointment of Liquidators – COMPONENT AGENCIES LIMITED

Appointment of Liquidators – OGT FUTURUM LTD

Appointment of Liquidators – FBW PROJECTS LIMITED

Appointment of Liquidators – PRECISION TECHNOLOGIES GROUP (US) LIMITED

Appointment of Liquidators – RAVEN ROSE LTD

Appointment of Liquidators – HILLPARK PROPERTIES LIMITED

Appointment of Liquidators – MWHW CONSULTING LTD

Appointment of Liquidators – CP1 LIMITED

Appointment of Liquidators – ES-J CONSULTING UK LIMITED

Appointment of Liquidators – THACHILS TECHNOLOGIES LIMITED

Appointment of Liquidators – LONDONFLAT54 ENTERPRISES LIMITED

Appointment of Liquidators – GRAYTECH SOLUTIONS LIMITED

Appointment of Liquidators – PHOENIX INTERIM MANAGERS LTD

Appointment of Liquidators – PURPLE SECTOR CONSULTING LTD

Appointment of Liquidators – ADENLOCH LIMITED

Appointment of Liquidators – RZENG SERVICES LIMITED

Appointment of Administrator – SAMPER INSTALLATION LIMITED

Petitions to wind up (Companies) – JLB STEELS LIMITED

Appointment of Liquidators – PIONEER NINE LIMITED

Appointment of Liquidators – M.E.A PROPERTIES LIMITED

Appointment of Liquidators – L P B DEVELOPMENTS LIMITED

Appointment of Liquidators – WILTOG LTD

Petitions to wind up (Companies) – ELEVEN11 UTILITIES LTD

Petitions to wind up (Companies) – L TEALE SCAFFOLDING SERVICES LTD

Appointment of Liquidators – WG PRACTICE HOLDINGS LIMITED

Petitions to wind up (Companies) – UKAP HOLDINGS LIMITED

Winding up Order (Companies) – L J S TRANSPORT OF SETTLE LIMITED

Winding up Order (Companies) – TRENCHFIELD VINE HOLDINGS LLP

Appointment of Liquidators – NEWFORM DISTRIBUTION LIMITED

Appointment of Administrator – LEVANTINA (UK) LIMITED

Appointment of Liquidators – ASHRIDGE MEDICAL LIMITED

Petitions to wind up (Companies) – GRIFFINS TRANSPORTS & LOGISTICS LTD

Appointment of Liquidators – TRUFFLES SOUTH WEST LIMITED

Why you should become a member of CPA!

The Credit Protection Association (CPA) has been assisting thousands of UK businesses to get paid, since 1914. We have supported our members through all sorts of difficult trading environments. With high interest rates and a struggling economy and elevated insolvencies, our services can help your business navigate these difficult waters.

Unlike other credit management and debt collection companies, we offer a range of services to our members that are all included as part of a fixed annual subscription, tailored to your needs.

Under your annual subscription you will have access to our main services:

- Our Creditcare credit reports provide credit ratings and limits along with a host of detailed information on your potential customers to enable you to trade with confidence and set appropriate credit policies for new customers.

- Our monitoring service will alert you to any significant changes in the status of those customers.

- Our Overdue account recovery service can be used to chase up payment on any invoices to those customers that have not been paid on time. Unlike other debt collection companies, this service directs your customer to pay direct to you and allows you to maintain your goodwill with them, rather than inserting ourselves into your relationship with you customer and insisting they pay CPA instead. Our Overdue account recovery service resolves over 80% of accounts referred to us.

All of the above services and other complimentary services such address verification, are included in your subscription!

And for the small minority of debts not resolved through our Overdue account recovery service, you can refer the debt to our collections department to escalate the late payment collections process.

CPA eases cash from tardy debtors – Efficiently, Effectively, Economically and Ethically. And we provide credit information so you can monitor and assess your key customers and be warned of any potential risks. CPA has been improving business cash flow for over 100 years, by tackling late payers and campaigning against the late payment culture in the UK.

Unlike other credit management companies, we offer our members a fixed annual subscription regardless of how high the value of their debts maybe!

Rather than to borrowing more money to improve your cashflow, CPA suggests that business owners tackle the problem at its source. If late payments are a strain on your cashflow, then talk to CPA about how we can help you reduce those late payments.

Just call Peter Uwins, CPA’s National Sales Manager, on 020 8846 0000 (business hours) or email nsm@cpa.co.uk today.

When you see your money come in, you will be so glad you used CPA.

The Credit Protection Association – Prompting Punctual Payments – Ethical, Effective, Efficient, Economical collections

Do you have a commercial late payer that is causing you grief? Use CPA’s no-win, no-fee, commercial debt recovery service!

If you have a particular business customer who is late paying and causing you sleepless nights, why not offer it to CPA’s collection department for purchase on recourse?

CPA’s collection department will then pursue the debt. We will be liable for any costs incurred and then when we have recovered the debt, we will pay you the net principle debt recovered less our percentage.

Once you have enjoyed that success then you can consider the more cost effective membership which includes our Overdue Account Recovery service and Status/Credit reports as well as a range of other complimentary services.

Just call 020 8846 0000 and ask for Godfrey Nelson or Cris Shirley (business hours) or email debtpurchase@cpa.co.uk today.

The Credit Protection Association – Prompting Punctual Payments – Ethical, Effective, Efficient, Economical collections.

Get compensated for previous late payments

Have you been paid late by business customers in the last six years?

Maybe you no longer work with them. Under legislation, you are entitled to compensation you for those late payments you have suffered.

You put up with the PAIN – now claim the GAIN!

Claim late payment compensation (LPC) from former business customers who paid you late in the last six years!

CPA (LPC) Recoveries is using our bespoke software and decades of experience to do just that for our clients

Check our compensation calculator to see how much your business could be owed!

Discover NOW the potential value of late payment compensation hidden in your sales ledger!

The Credit Protection Association – Prompting Punctual Payments – Ethical, Effective, Efficient, Economical collections.