CPA’s CreditCare Reports

CPA has been supplying commercial credit reports to its members for over 40 years now. Altogether we have worked with four re-suppliers, two of which have amalgamated with other credit information companies. The issue is that no matter who they are large or small, however reputable or long standing there is a percentage of error in some information supplied or with the recommended credit limits and ratings. Up to 5% of company reports are inaccurate in some way or another.

Since there are over 5 million incorporated companies in the UK, including those dormant or those in the process of winding up or with subsidiaries etc. Humans cannot scrutinise all the reports, therefore algorithms are utilised to calculate credit ratings based on the many thousands of items of raw data held. However, they cannot be 100% relied upon as sometimes data can be falsified or incorrect and therefore users are advised to use their own discretion and take into account other data factors when deciding whether to give credit.

Perhaps the biggest element of risk applies when a brand new potential customer, previously unknown to the supplier, seeks to purchase goods on credit for a substantial amount.

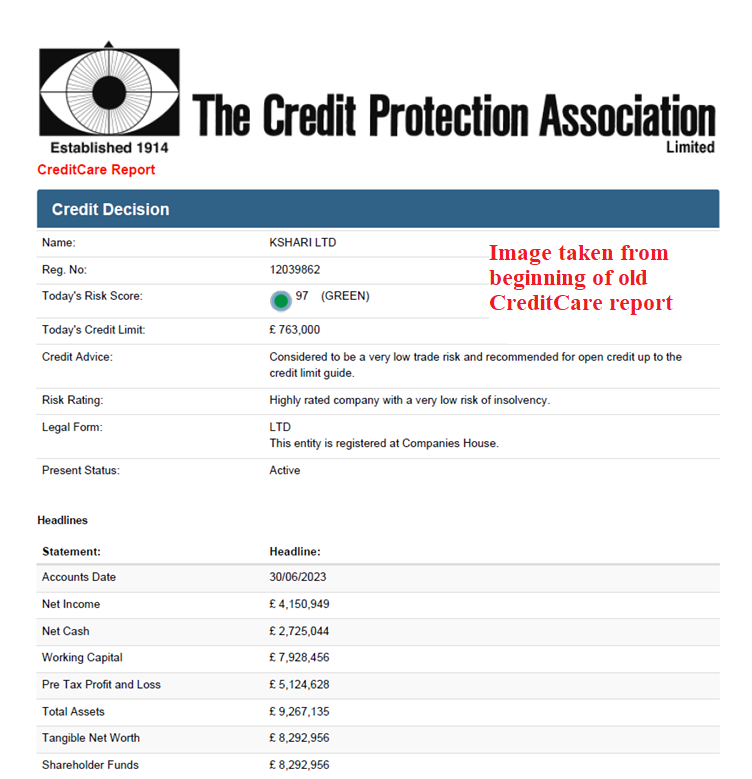

An example of this occurred in early July when a long-standing Member of CPA, (who has been subscribing for over 24 years) sent an email to Godfrey Nelson in our collections department regarding credit sought for £15,000 by company number 12039862 Kshari Ltd. In looking at the CreditCare report Godfrey got a sense that there was something suspect regarding the figures shown on the report. The algorithms that are used in the report showed at the time showed a credit limit of £763,000; with a risk score 97 (GREEN) (out of 100) and the credit advice was shown as “considered to be a very low trade risk and recommended for open credit up to the limit”.

Immediately, Godfrey saw that this company incorporated in June 2019 existed and was registered at Companies House and that they had filed several years of strong accounts.

However, closer investigation gave reason for suspicion. Having previously filed micro accounts for several years, over the space of a couple of months they had re-filed 3 sets of financial statements, massively inflating their previous year numbers. The figures that had been submitted to Companies House in its financial statements that supported its credit limit were grossly falsified. Why? To make the algorithms used by credit agencies give them an inflated credit rating which they could then use to obtain credit for goods which they could not or more accurately would not pay for.

Looking at Kshari’s website provided still further evidence as it seemed purposefully constructed to mislead to gain credibility with numerous fake accreditations which on further investigation proved false. The Registered Office address is a storage unit and the website shows a trading address from a residential home. The company is not a Member of the Management Consultancies Association and certainly not an “MCA Awards finalist 2023” as they claimed to be!

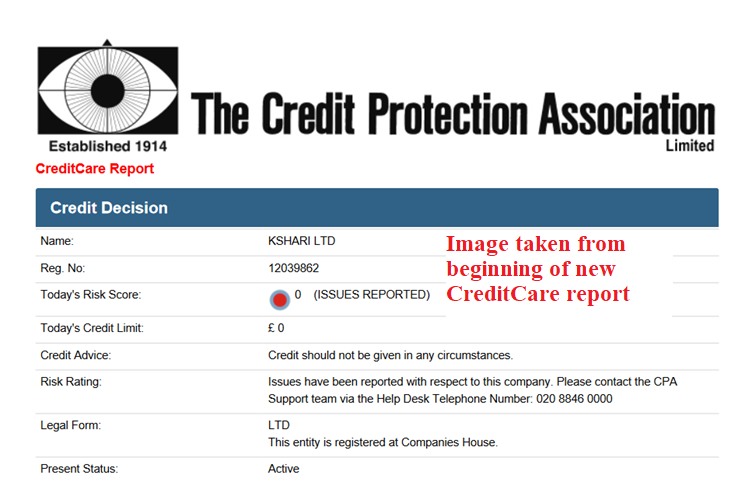

As a result of this, CPA have overridden our supplier’s information and now shows the risk score at 0 with a warning notation and todays credit limit as zero. (However, if you happen to be supplied by other credit information companies you will note that up to the most recent viewings they still show Kshari’s high recommended credit limits for this company).

This is an example that numbers alone cannot always be trusted. Through our membership, we are seeing more and more examples of credit fraud. Please examine carefully new customers who seek credit for large orders. CPA prides itself on providing a bespoke service with a human touch. When in doubt we encourage our members to always feel free to contact Godfrey Nelson, Cris Shirley or any other senior staff at CPA who will be pleased to assist.

Yours sincerely,

David S. Baber

Managing Director

31/07/2024

Why you should become a member of CPA!

The Credit Protection Association (CPA) has been assisting thousands of UK businesses to get paid, since 1914. We have supported our members through all sorts of difficult trading environments. With high interest rates and a struggling economy and elevated insolvencies, our services can help your business navigate these difficult waters.

Unlike other credit management and debt collection companies, we offer a range of services to our members that are all included as part of a fixed annual subscription, tailored to your needs.

Under your annual subscription you will have access to our main services:

- Our Creditcare credit reports provide credit ratings and limits along with a host of detailed information on your potential customers to enable you to trade with confidence and set appropriate credit policies for new customers.

- Our monitoring service will alert you to any significant changes in the status of those customers.

- Our Overdue account recovery service can be used to chase up payment on any invoices to those customers that have not been paid on time. Unlike other debt collection companies, this service directs your customer to pay direct to you and allows you to maintain your goodwill with them, rather than inserting ourselves into your relationship with you customer and insisting they pay CPA instead. Our Overdue account recovery service resolves over 80% of accounts referred to us.

All of the above services and other complimentary services such address verification, are included in your subscription!

And for the small minority of debts not resolved through our Overdue account recovery service, you can refer the debt to our collections department to escalate the late payment collections process.

CPA eases cash from tardy debtors – Efficiently, Effectively, Economically and Ethically. And we provide credit information so you can monitor and assess your key customers and be warned of any potential risks. CPA has been improving business cash flow for over 100 years, by tackling late payers and campaigning against the late payment culture in the UK.

Unlike other credit management companies, we offer our members a fixed annual subscription regardless of how high the value of their debts maybe!

Rather than to borrowing more money to improve your cashflow, CPA suggests that business owners tackle the problem at its source. If late payments are a strain on your cashflow, then talk to CPA about how we can help you reduce those late payments.

Just call Peter Uwins, CPA’s National Sales Manager, on 020 8846 0000 (business hours) or email nsm@cpa.co.uk today.

When you see your money come in, you will be so glad you used CPA.

The Credit Protection Association – Prompting Punctual Payments – Ethical, Effective, Efficient, Economical collections