Late Payments to UK SMEs: Why Fixing the Problem Beats Financing It

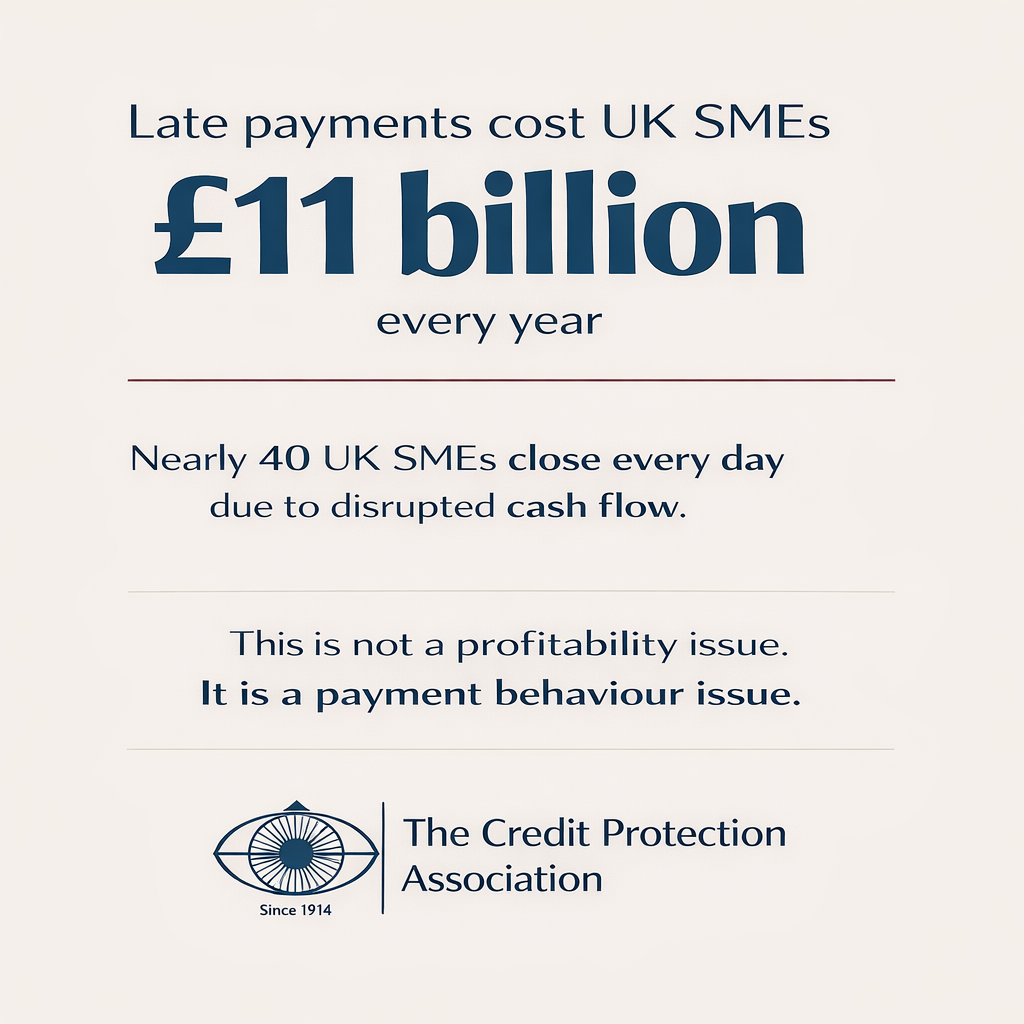

Late payments to UK SMEs continue to suffocate the economy. The cost is now estimated at £11 billion per year, with thousands of otherwise viable businesses pushed into difficulty simply because invoices are not paid on time. Nearly 40 UK SMEs close every day as a direct result of disrupted cash flow.

This is not a profitability issue. It is a payment behaviour issue.

A business can be busy, growing, and profitable on paper — yet still fail if customers consistently pay late. Delayed income restricts payroll, investment, tax compliance and growth, forcing owners to spend more time firefighting cash flow than building their business.

Why late payment culture persists

Despite years of voluntary codes and awareness campaigns, late payment remains deeply entrenched. The reasons are well known:

- Power imbalance

Larger organisations impose extended payment terms that smaller suppliers feel unable to challenge. - Weak enforcement

Schemes like the Prompt Payment Code lack real consequences for persistent late payers. - Cash flow hoarding

Some businesses deliberately pay late to improve their own balance sheets at their suppliers’ expense. - Inadequate credit control

Many SMEs lack the time, tools or confidence to monitor customer risk and chase overdue invoices consistently.

The result is a damaging chain reaction. One late payment leads to another, suppliers delay their own obligations, and pressure ripples through entire supply chains.

Government reform helps — but doesn’t solve today’s problem

The government’s 2025 reforms signal a welcome shift. Mandatory payment reporting, reduced payment terms and board-level accountability should improve transparency over time.

But for SMEs dealing with late payments right now, reform does not pay wages, VAT bills or suppliers. Enforcement will take time — and late payment culture does not disappear overnight.

The real cost of “funding around” late payment

Many businesses are encouraged to solve late payment by borrowing against invoices. While this can provide short-term relief, it does not address the root cause.

Invoice finance:

- Charges businesses to access money they have already earned

- Normalises poor payment behaviour

- Reduces margins through fees and interest

- Leaves the late payer’s behaviour unchanged

In effect, the supplier pays the price for the customer’s delay.

A better approach: prevent late payment and recover it properly

Late payment is not a funding problem — it is a credit management problem.

This is where CPA takes a different approach.

Instead of encouraging businesses to borrow more, CPA helps Members:

- Assess risk before trading using CreditCare credit reports and limits

- Monitor customers continuously for early warning signs

- Recover overdue invoices professionally without damaging relationships

Crucially, when CPA chases overdue accounts:

- Payment is made directly to you

- Your customer relationship is preserved

- You retain full visibility and control

- Over 80% of overdue accounts are resolved without escalation

For the small minority that require further action, CPA can escalate ethically through its collections department — again, without pushing Members into percentage-based funding arrangements.

Fix the working capital chain — don’t mask it

Late payments break the working capital cycle:

Sales are made

Invoices are issued

Payment is delayed

Cash flow tightens

Risk increases

You may appear profitable on paper, but cash inflows tell the real story.

By improving payment behaviour itself — not financing around it — businesses restore control, reduce risk, and protect margins.

The smarter alternative to borrowing

CPA membership provides:

- Credit reports and monitoring

- Overdue account recovery

- Address verification and complementary services

- All for a fixed annual subscription, regardless of debt value

No interest.

No erosion of profit.

No reliance on someone else’s bad habits.

Ready to take control of late payments?

If late-paying customers are affecting your cash flow, the answer is not to borrow more — it’s to get paid properly and on time.

Call 020 8846 0000 (business hours)

Email nsm@cpa.co.uk

The Credit Protection Association

Improving cash flow. Protecting relationships.

Prompting punctual payments since 1914.